What's Right For Me?

Finding the right mortgage for you

Finding the right mortgage for you

A mortgage term is the length of time you're committed to a mortgage rate, lender, and associated conditions. Once your term is up, you may be able to renew your mortgage loan into a new term and rate or pay off the balance in full.

The Police Credit Union offers terms that range from 6 months to 5 years.

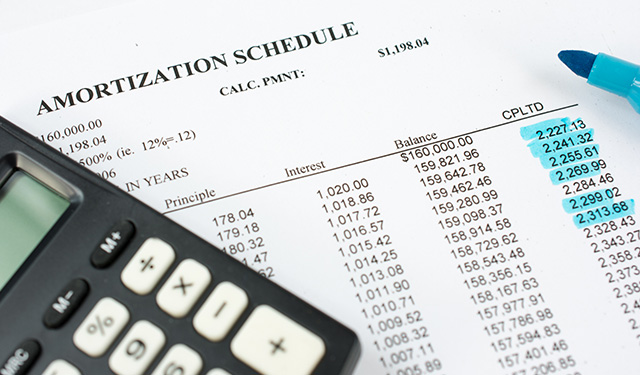

A mortgage amortization is the length of time that it will take to pay your mortgage in full.

The maximum amortization for a high ratio mortgage is 25 years and 30 years for a conventional mortgage.

A mortgage term is the length of time you're committed to a mortgage rate, lender, and associated conditions. Once your term is up, you may be able to renew your mortgage loan into a new term and rate or pay off the balance in full.

The Police Credit Union offers terms that range from 6 months to 5 years.

A mortgage amortization is the length of time that it will take to pay your mortgage in full.

The maximum amortization for a high ratio mortgage is 25 years and 30 years for a conventional mortgage.

A closed rate variable mortgage provides you a mortgage with predictable payments and an interest rate that will fluctuate with our Credit Union prime rate. This is ideal when interest rates are dropping. If interest rates rise so will your cost of borrowing.

A closed fixed rate mortgage provides you with predictable payments and the certainty your mortgage rate will not change for the term of your mortgage.

An open fixed rate mortgage provides you a mortgage with predictable payments and the certainty your mortgage rate will not change for the term of your mortgage.

In addition it may be paid down or off at anytime without penalty.

A closed rate variable mortgage provides you with a mortgage with predictable payments, however your rate will fluctuate based on the Credit Union prime rate. This is ideal when interest rates are dropping but in an increased rate environment your payments might not be sufficient to cover your required interest cost which can increase your amortization, your mortgage payments may increase significantly at renewal time.